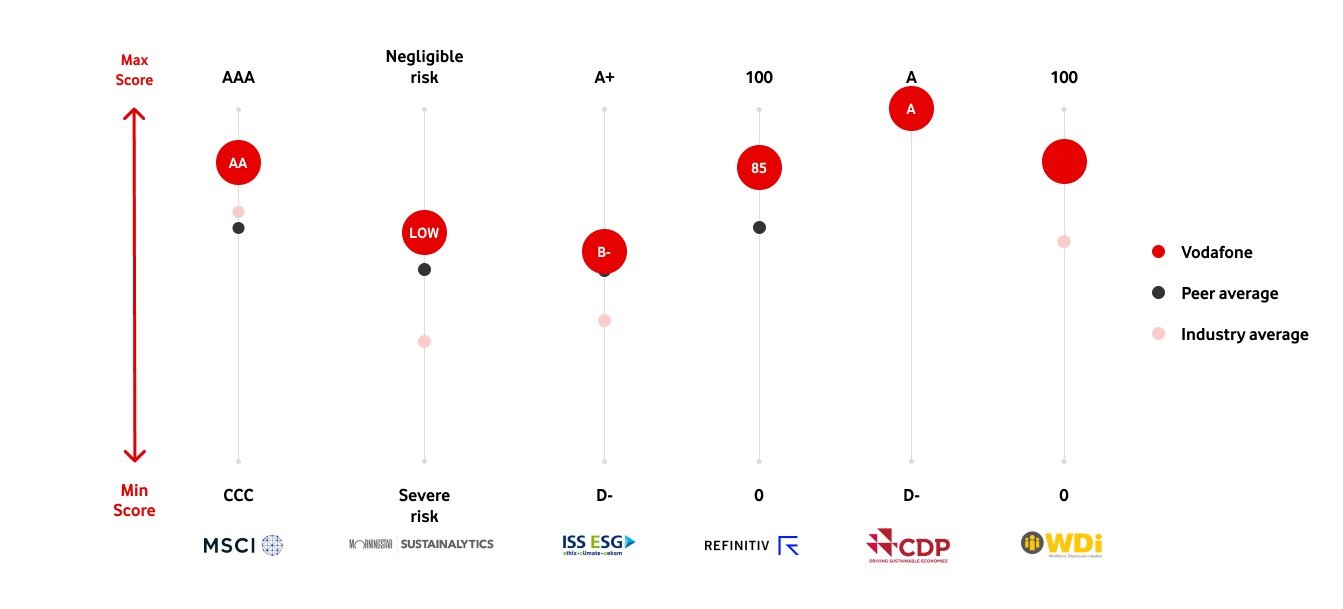

Vodafone's ESG profile, performance and transparency is assessed by a number of independent agencies. The chart immediately below shows that Vodafone Group Plc is consistently ranked highly compared to other telcos and our closest peers.

We recognise that investors and other stakeholders seek sustainability information that is clear, comparable, consistent and financially material. For more information on our ESG strategy, performance and disclosures, please refer to our latest Annual report or the ESG reporting section.

ESG rating graph

Data correct as of 24th February 2025. Peer group includes BT Group, Deutsche Telekom, Liberty Global, MTN, Orange, Royal KPN, Telecom Italia, Telefonica, and Telefonica Deutschland.

ESG ratings agencies

ESG Ratings Agencies provide an opinion on a company’s ESG profile. Many agencies only focus on the financially material impact of ESG risks and opportunities on company performance, whereas others may also consider a company’s impact on stakeholders and broader society. The agencies typically summarise their analysis and conclusions with a proprietary scoring or rating system and then rank the assessed company against a peer group.

There is no widely agreed definition of ‘ESG’ amongst market participants and the purpose or objectives of ESG ratings can be very different. Ratings often differ amongst providers because of three factors: (i) Scope (i.e. what they assess); (ii) Measurement (i.e. how they assess); and (iii) Weight (i.e. the relative importance of assessed topics).

To access additional context and commentary on Vodafone Group's latest ESG ratings as determined by a number of popular ESG Ratings Agencies, please click on each agency in the red banner immediately below.

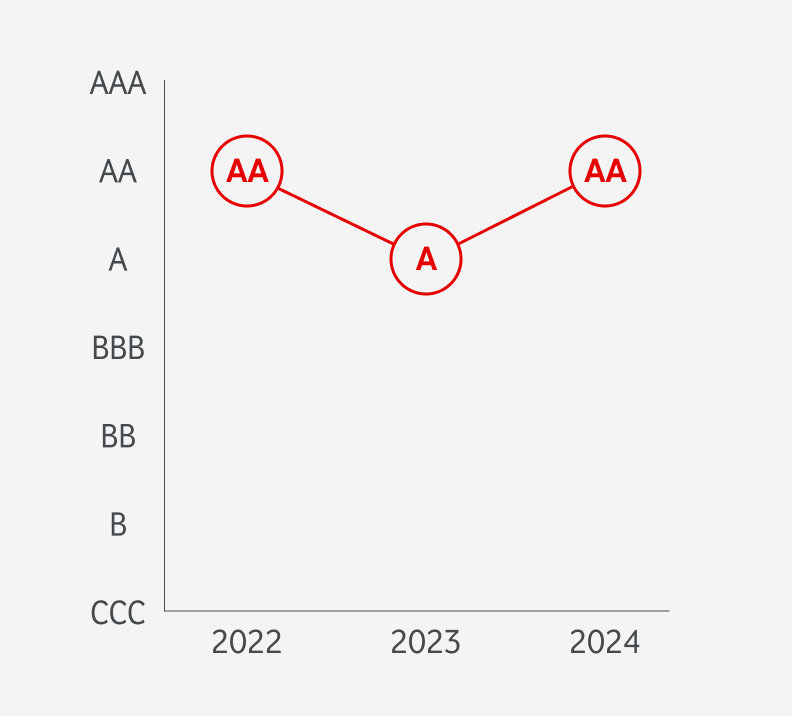

In 2024, Vodafone Group Plc received a rating of AA (on a scale of AAA-CCC) in the MSCI ESG Ratings assessment. The change in score was driven by changes in MSCI methodology.

Description of MSCI ESG Ratings assessment

MSCI ESG Research provides MSCI ESG Ratings on global public and a few private companies on a scale of AAA (leader) to CCC (laggard), according to exposure to industry-specific ESG risks and the ability to manage those risks relative to peers. Learn more about MSCI ESG ratings here.

MSCI's ESG Ratings are based on exposure and management scores, with data from a wide variety of sources (not just voluntary company reporting). Exposure scores are driven by business operations, geography and company-specific factors. Management scores are informed by a company's practices, targets and public disclosures and are a measure of how well that company manages the risks identified by MSCI. Per MSCI, approximately 45% of an ESG Rating is currently based on company-reported ESG information, of which most is voluntary. The rest of the rating is informed by other third-party sources.

MSCI's independent assessment of a company’s risk exposures can have a significant impact on the overall ESG Rating but is often not within that company’s control. The impact becomes clearer when comparing Vodafone Group's weighted average key issue score (WAKI) – which is used to determine Vodafone's final industry adjusted score and rating (AA) – to the same scores for Vodafone's African subsidiary, Vodacom Group (AAA). We have found that approximately 75% of the difference between the WAKIs for Vodafone and Vodacom can be explained by a single theme within MSCI's ESG Rating, 'Labour Management', and specifically MSCI's independent assessment of risk exposures (i.e. outside Vodafone’s control).

As Vodacom Group is part of the Vodafone Group, policies, programmes and practices related to labour management are almost like-for-like and this is reflected in MSCI's assessment; the management ‘practices’ scores for labour management are identical across both companies. However, Vodafone Group's exposure score for labour management risks is significantly higher than the same exposure score for the Vodacom Group. MSCI attribute this to the fact that the Vodafone Group has operations in Europe where there is a "high likelihood of labour unrest (based on historic precedent)". As the labour management theme contributes almost 25% to the Vodafone’s MSCI ESG Rating, MSCI's view that the risk exposure is higher in Europe compared to Africa has a significant negative impact on Vodafone's MSCI ESG Rating.

Following their 2022 consultation, in 2023 MSCI changed their methodology to raise the requirements for a fund to be assessed as "AA" or "AAA" rated to improve the stability and add transparency. According to MSCI, this means the distribution of the ratings will shift, with a significant amount of one-time downgrades. Changes to underlying methodologies can have an impact on ESG ratings and reduce comparability over time.

Users should also note that Vodafone's weighted average key issue score (WAKI) can change throughout the year but the ultimate ‘industry adjusted score’ (IAS) - which is used to determine the final rating - is only updated and recalibrated once a year.

In October 2023, Vodafone Group Plc received an ESG Risk Rating of 16.2 and was assessed by Sustainalytics to be at low risk of experiencing material financial impacts from ESG factors. As a result currently has the 15th lowest ESG Risk Rating in the global telecommunications industry.

Description of Sustainalytics ESG Risk Rating

Sustainalytics’ ESG Risk Ratings measure a company’s exposure to industry specific material ESG risks and how well a company is managing those risks. This multi-dimensional way of measuring ESG risk combines the concepts of management and exposure to arrive at an assessment of ESG risk, i.e. a total unmanaged ESG risk score or the ESG Risk Rating, that is comparable across all industries. Sustainalytics’ ESG Risk Ratings provide a quantitative measure of unmanaged ESG risk and distinguish between five levels of risk: negligible, low, medium, high and severe. Learn more about the ESG Risk Ratings here.

We highlight that Sustainalytics' ESG Risk Ratings are based on Sustainalytics' own assessment of our risk exposure (uncontrollable) and risk management (controllable). Approximately one quarter of our latest ESG Risk Rating is outside our control ('unmanageable risk exposure'), with the remainder heavily influenced by Sustainalytics' own assessment of the risk exposures that are manageable.

Sustainalytics' ESG Risk Rating also reflects events that, in their view, may negatively impact our stakeholders or operations. We estimate that approximately one quarter of our latest ESG Risk Rating is driven by the ‘controversies’ identified by Sustainalytics. We have provided feedback to Sustainalytics that many of these events are: (i) based on unsubstantiated allegations where no competent authority has found wrongdoing; (ii) immaterial (one example relates to a US$1,000 fine in a joint ventures); and (iii) are a number of years old but continue to be considered if referenced in more recent news reports.

Users should be aware that Sustainalytics' ESG Risk Rating report does not provide the detail supporting each controversy and only presents the headlines in the core report. We would recommend users of Sustainalytics' analysis review the separate Controversy Report in detail and reach their own conclusions as to the relevance, accuracy and financial materiality of the events identified by Sustainalytics.

In September 2023, Vodafone Group Plc received an ISS ESG Corporate Rating of B (on a 12-point scale of A+ to D-). We have also been awarded 'Prime status' as our ESG performance is above the sector-specific threshold defined by ISS. Our Prime status shows that we fulfil ambitious absolute sustainability performance requirements. The underlying score supporting the B rating places Vodafone Group Plc in the top decile in the global telecommunications industry, as defined by ISS.

Our rating improved by one notch in 2022 due to improvements in our ESG KPIs, increased transparency and engagement with ISS.

Description of ISS ESG Corporate Rating

ISS ESG's Corporate Rating provides investors with relevant, material and forward-looking ESG data and performance assessments. A company’s management of ESG issues is analysed on the basis of up to 100 rating criteria, many of which are sector-specific. The rating not only evaluates company policies and declarations of intent, it also assesses the sustainability performance of products and production processes. Learn more about ISS ESG Corporate Ratings here.

ISS defines ‘key issues’ for every industry, reflecting the industry’s most challenging social and environmental issues. Indicators assessing our performance in the key issues identified by ISS account for 67% of the overall rating. A number of the indicators used to assess these key issues have a high weighting. For example, only 15 indicators account for 50% of our overall ISS ESG Corporate Rating.

Furthermore, the ISS ESG Corporate Rating also includes an assessment of the impact of a company’s product and service portfolio on social and environmental sustainability objectives, based on the UN Sustainable Development Goals ('SDGs'). The overall grade is determined by the estimated share of net sales generated with relevant products or services contributing to or obstructing the achievement of the most material objectives for a company's business model. These indicators (percentage of revenue) are similar to those required under various 'taxonomies' that are being introduced around the world. Taxonomies are classification systems which help companies identify and report on the share of revenue earned from defined sustainable economic activities. The key challenge is that many companies, including Vodafone, do not currently report financial performance on an activity-by-activity basis or in the manner sought by ISS. The grading is therefore affected by limited public disclosure.

Whilst the ISS ESG Corporate Rating us updated annually; we are only invited to engage in the formal feedback process every 2-3 years. We engaged with ISS for the first time in 2022. We are able to share updates at any time but this is after the normal annual update process.

In September 2023, Vodafone Group Plc received a Refinitiv ESG score of 86 out of 100. This score places Vodafone Group Plc in the number two position within the global telecommunications sector.

The small decrease of 2 percentage point in our ESG score was driven by a lower score in the 'community' category, specifically as a result of lower Corporate Responsibility awards.

Users of Refinitiv ESG scores may also see the percentage score translated into letter grades on a 12-point scale (A+ to D-). On this basis, Vodafone's ESG score is equivalent to an A rating, which indicates excellent relative ESG performance and a high degree of transparency in reporting material ESG data publicly.

Description of Refinitiv ESG score

ESG scores from Refinitiv are designed to transparently and objectively measure a company's relative ESG performance, commitment and effectiveness across the three E, S and G pillars and 10 main themes based on publicly reporting information. More information on Refinitiv's ESG score is available here.

Refinitiv's ESG scores are primarily focused on a company's operations, rather than the impact of its products or services throughout the company's value chain. This is because Refinitiv recognises that it is much harder for companies to report on the social or environmental impact of their products and services in an objective and measurable way as reporting standards are still evolving.

Refintiv's ESG scores are relative and based on a percentile rank scoring methodology to calculate the 10 category scores. This methodology considers three key factors: (i) How many companies are worse than the current one?; (ii) How many companies have the same value?; and (iii) How many companies have a value at all?.

Refinitiv's database is updated on a continuous basis and data is refreshed every week, including the recalculation of the ESG scores. Updates could include a brand-new company being added to the database (and hence impacting the relative scoring for a company in the same industry), the latest fiscal year update or the inclusion of new controversy events. In most cases, reported ESG data is updated once a year in line with companies’ own ESG disclosure.Whilst Refinitiv's ESG scores are primarily based on company-disclosed data, Refinitiv also provides 'controversy' scores based on impact and conduct reported by global media sources. We are not provided the ability to review or share feedback on the accuracy or relevance of controversies identified by Refinitiv. If the controversy score is less than the ESG score, Refinitiv produces an "ESG Combined Score" which is based on a simple average of the controversy score and the ESG score. This Combined Score is not freely available but we would advise users that because it is based on a simple average, the weightings assigned to the material indicators reflected in the ESG score are effectively halved, no matter the number or materiality of the controversies identified by Refinitiv.

There are also a number of specialist ratings that focus on particular topics that fall under the ESG acronym. Instead of providing a view on a company's overall ESG profile (which as noted above, requires assumptions about relative importance of individual topics), these specialist ratings focus on particular elements within the ESG acronym, such as 'E', 'S' or 'G', or indeed particular topics, such as climate change or workforce matters. The two disclosure initiatives below have significant investor support and we actively engage and respond to their questionnaires each year.

We have been measuring and reporting on energy and carbon emissions since 2001 and have been responding to the climate change questionnaire issued by CDP, a global environmental non-profit organisation, since 2010. CDP runs the global disclosure system for investors, companies, cities, states and regions to manage their environmental impacts.

At the start of 2024, we were recognised by CDP for our actions and transparency with respect to our environmental impact and retained an A rating (2023: A). This places us in the leadership band, which is higher than the average rating of B in Europe and in the top third of companies in our sector.

Vodafone was also one of the founding members of the CDP Supply Chain. In 2022, Vodafone was recognised as a Supplier Engagement Leader by CDP, based on our 2022 CDP disclosure. This recognises our actions to engage our suppliers to manage climate risk and reduce carbon emissions in our supply chain.

A detailed and independent methodology is used by CDP to assess companies, with CDP allocating a score of A to D- on an eight-point scale based on the comprehensiveness of disclosure, awareness and management of environmental risks and demonstration of best practices associated with environmental leadership, such as setting ambitious and meaningful targets. CDP is constantly evolving their disclosure and scoring system in response to market needs and more information can be found here.

There are also a number of specialist ratings that focus on particular topics that fall under the ESG acronym. Instead of providing a view on a company's overall ESG profile (which as noted above, requires assumptions about relative importance of individual topics), these specialist ratings focus on particular elements within the ESG acronym, such as 'E', 'S' or 'G', or indeed particular topics, such as climate change or workforce matters. The two disclosure initiatives below have significant investor support and we actively engage and respond to their questionnaires each year.

The Workforce Disclosure Initiative ('WDI') aims to improve corporate transparency and accountability on workforce issues, provide companies and investors with comprehensive and comparable data, and help increase the provision of good jobs worldwide. Around 170 global companies took part in the Initiative, demonstrating their commitment to transparency.

We responded to the survey for the first time in 2020 as we understood that investors and other stakeholders were seeking increased transparency and comparable workforce data. Whilst our responses are made available to the WDI investor coalition, we also choose to make our full response public via the WDI's website here.

Following our latest response in 2023, we were delighted to receive a disclosure score that was above average across all responders, as well as those in the communications sector.

Disclaimer

The references to various ESG Ratings on this page do not constitute a sponsorship, endorsement, recommendation, or promotion by Vodafone Group Plc. The ratings are provided 'as-is' and based on proprietary methodologies which can significantly differ between providers, evolve over time and/or reflect factors outside Vodafone's control. We do not warrant that the underlying information supporting these ratings is accurate, complete, timely or suitable for any particular purpose. The use of each ESG rating is subject to the conditions of the relevant provider and more information on each ESG rating can be found on the providers' websites.

The use by Vodafone Group Plc of any MSCI ESG Research LLC or its affiliates ("MSCI") data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of Vodafone Group Plc by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided 'as-is' and without warranty. MSCI names and logos are trademarks or service marks of MSCI.

Copyright ©2023 Sustainalytics. All rights reserved. This section contains information developed by Sustainalytics (www.sustainalytics.com). Such information and data are proprietary of Sustainalytics and/or its third party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers

ESG A-Z

Search for our latest ESG disclosures, including our Code of Conduct, Code of Ethical Purchasing, Human Rights Policy Statement, Cyber Security Factsheet and more.