Capital allocation principles

In March 2024, Vodafone conducted a broad capital allocation review, considering the Group’s strategy within its reshaped footprint. This review has concluded the following key outcomes:

- country-level capital intensity to be broadly maintained at existing levels;

- maintain robust balance sheet with new leverage policy of 2.25x – 2.75x Net debt to Adjusted EBITDAaL, targeting to be in bottom half of the range;

- Ordinary dividend to be rebased to 4.5c. per share from FY25 onwards, with an ambition to grow it over time.

- A share buyback programme of €2.0 billion was announced in FY25 following the sale of Vodafone Spain and subsequently announced a further €2.0 billion share buyback programme in FY26 following the sale of Vodafone Italy.

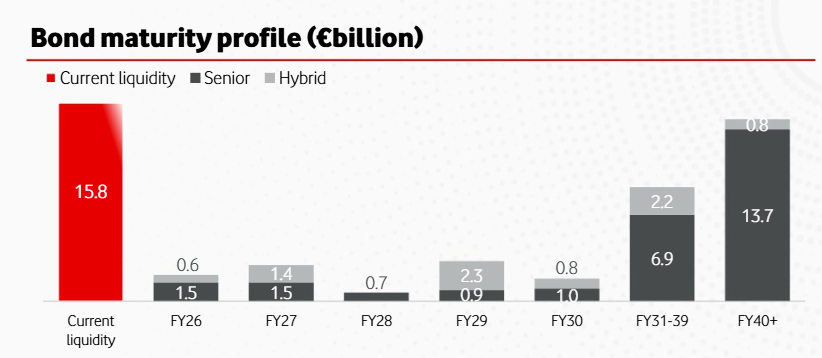

The Group's policy is to borrow centrally across a diversified selection of currencies using predominantly medium and long-term capital market issues.

In respect of certain emerging markets, we may elect to borrow on a non-recourse basis.

Our mid to long-term debt is primarily financed via corporate bond programmes. Any short-term funding requirements are met through our commercial paper programme.

We have three bond programmes to meet our medium to long-term funding requirements; two €30 billion euro medium-term note (EMTN) programmes and a US shelf programme.

Hybrid bonds

The bond maturity profile includes hybrid securities, the key features of which are:

- Legal maturity of 60 years but are callable between FY26 and FY51.

- Attract 50% equity treatment from all three major credit rating agencies (Moody’s, S&P and Fitch).

- A permanent part of our capital structure.

- Treated at 100% debt in our accounts and net debt to adjusted EBITDaL calculation.

We have three bond programmes to meet our medium to long-term funding requirements; two €30 billion euro medium-term note (EMTN) programmes and a US shelf programme.

As part of its commitment to sustainability, Vodafone Group Plc has designed a Sustainable and Sustainability-linked Framework (the ‘Framework’) under which Vodafone can issue green, social, sustainability and sustainability-linked funding instruments to finance or refinance projects enabling the company to meet its environmental and/or social objectives. This Framework replaces Vodafone’s Green Bond Framework which was published in August 2018.

The latest Framework, published in September 2021, sets out what projects are eligible under the use of proceeds, the process for project evaluation and selection, the management of proceeds, and reporting. The Framework also sets out our new sustainability-linked finance framework, which covers key performance indicators, sustainability performance targets, the characteristics of financing instruments, reporting, and verification.

Sustainalytics, a provider of environmental, social and governance (ESG) research and analysis, has provided a second-party opinion on Vodafone’s Framework. Sustainalytics is of the opinion that the Framework is credible, impactful and aligns with International Capital Markets Association relevant principles. In Sustainalytics’ opinion, the strength of our selected key performance indicators is also strong or very strong and our targets are ambitious or highly ambitious.

In May 2020, Vodafone released its first Green Bond Report detailing how funds raised in accordance with Green Bond Framework had been fully allocated and the associated impact. Subject to issuance of applicable funding instruments, Vodafone will continue to report on the allocation of proceeds and the associated impact in the year(s) following issuance of any future funding instruments under the current Framework.

Sustainability Framework (FY22)

Sustainalytics Second Party Opinion (FY22)

Vodafone Green Bond Framework (FY19)

Maintaining leverage at the lower half of our 2.25-2.75x net debt to adjusted EBITDaL range is one of our three capital allocation priorities.

The other two priorities are:

- Invest appropriately in the business

- Provide an attractive return to shareholders

Vodafone maintains credit ratings with the three most prominent international credit rating agencies.

Vodafone’s current credit rating and outlook is included in the table below.

| Rating agency | Short term | Long term | Outlook |

|---|---|---|---|

| Moody's | P-2 | Baa2 | Stable |

| Fitch | F-2 | BBB | Positive |

| Standard and Poor's | A-2 | BBB | Stable |

The current position is consistent with our intention to maintain a solid investment grade rating.

Vodafone operates with a centralised Treasury function so that key Treasury risks are managed at a Group level.

Liquidity

Prudent level of available cash and unutilised credit facilities which cover near term bond maturities and cash requirements.

Bond maturities are limited in any one financial year to minimise refinancing risk.

Cash is centralised with Group Treasury wherever possible.

The Group maintains two Revolving Credit Facilities which provide backstop liquidity, US$4bn maturing March 2028 & €4bn maturing Feb 2030.

Investment

Investments are focused on short dated and highly liquid instruments.

Security and preservation of capital are the priorities.

Foreign Exchange Majority of debt is held in Euro, being the functional currency of the Group and representing the vast majority of the Group’s assets. Some debt is held in South African Rand to hedge the Group’s Vodacom asset. Bonds which are issued in currencies other than Euro are hedged into Euro using cross currency interest rate swap derivatives. Transactional currency exposures substantially hedged.

Credit Risk

All derivatives are executed with high investment grade financial institutions, the majority of which are Globally Systemically Important Institutions (as defined by the Financial Stability Board) Derivative positions are all collateralised by the banking counterparty

Interest Rate All bond debt is held on a fixed rate basis.

Contact us

Latest financial results